The modern world is filled with many technological wonders that make our lives much easier to navigate, such as digital payment systems, online contracts, and beyond. Unfortunately, these same systems can make our lives difficult when our personal data falls into the hands of malicious third parties.

Every week, news about failed cyber security, successful hacks, and data breaches comes out–and it can be hard to track whether or not a malicious actor got ahold of your details. It also seems like every company has been asking for more and more information as time goes on.

The good news? In the face of such modern threats, companies like OmniWatch offer services that can help us gain peace of mind and act fast if our personal data is stolen. In this OmniWatch review, we’ll take a closer look at some of its services.

OmniWatch Review: Monitor Data In Real Time With Two Different Plans

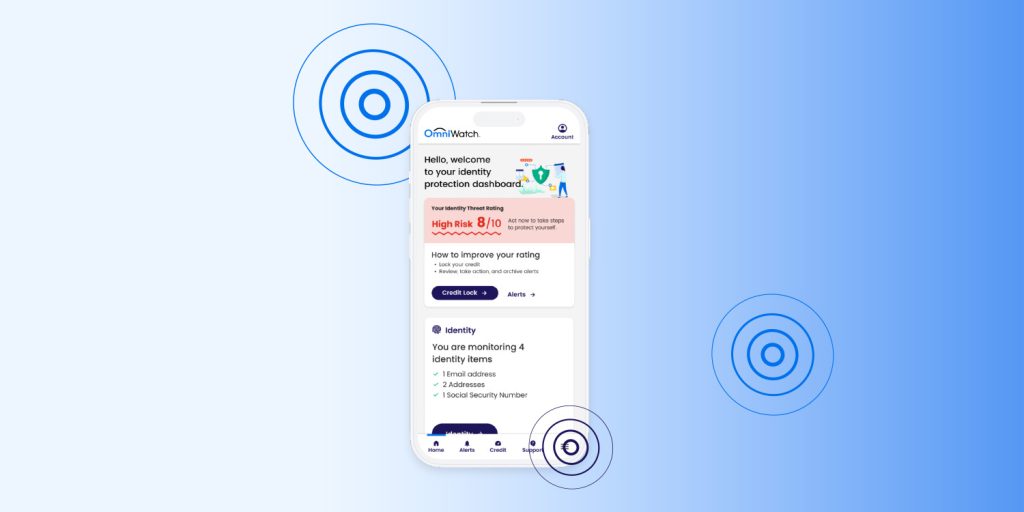

Most people believe identity theft could never happen to them. That is, until it does. While identity theft protection services offer ways to take precautions, OmniWatch observes in real time to help you monitor your own data.

OmniWatch is a high-quality and comprehensive identity monitoring service that helps individuals keep tabs on any changes to their credit reports, offers dark web monitoring, and more to ensure that they have the security and support they need in the event of identity theft.

Why We Love It

OmniWatch examines the internet, including the dark web, and tracks your credit health so you don’t have to.

Overall, we believe OmniWatch should be one of the main companies you consider if you’re looking to monitor various websites where your data could be leaked, access essential services that will help you navigate identity theft if they determine that someone has stolen your sensitive information, and receive the all-around protection you deserve.

This comprehensive coverage and focus on consumer satisfaction is what makes OmniWatch stand out to us. If you’re in the market for a service that will help you monitor identity theft, consumer credit, and more, we highly recommend turning to OmniWatch for the services you need.

OmniWatch Basic

What it is

OmniWatch offers two main services: the OmniWatch Basic plan and the OmniWatch Premium plan. The basic plan provides users with comprehensive identity monitoring services. This includes features like credit monitoring for Transunion, Equifax, and Experian, credit reports for all three, and ransomware protection.

If you’re concerned by all of the recent data breaches in the news and you want to give yourself protection but don’t believe you’ll need more of the advanced features, starting off with the OmniWatch Basic plan is an excellent way to get the foundational support you need.

How it works

So, what do you get when you sign up for the OmniWatch Basic plan? The OmniWatch Basic plan is an excellent starting point, offering:

- Dark Web Monitoring

- TransUnion® credit report monitoring

- Monthly TransUnion® Credit Reports & VantageScore® 3.0

- TransUnion® Credit Lock

- 24/7 U.S.-based dedicated identity restoration agents who will file paperwork on your behalf

- Up to $2 million in identity theft insurance (may cover legal services, lost wages, and hacked financial accounts)

They also offer additional features like an Identity Risk Score (based on accurate data that has already been breached and weaknesses that may expose you to risk) and more to help you tap into effective identity theft protection you may not find elsewhere.

If you’re interested in credit monitoring, identity theft protection, access to insurance, and more, the OmniWatch Basic plan is a good fit for you.

Learn more about OmniWatch Basic today

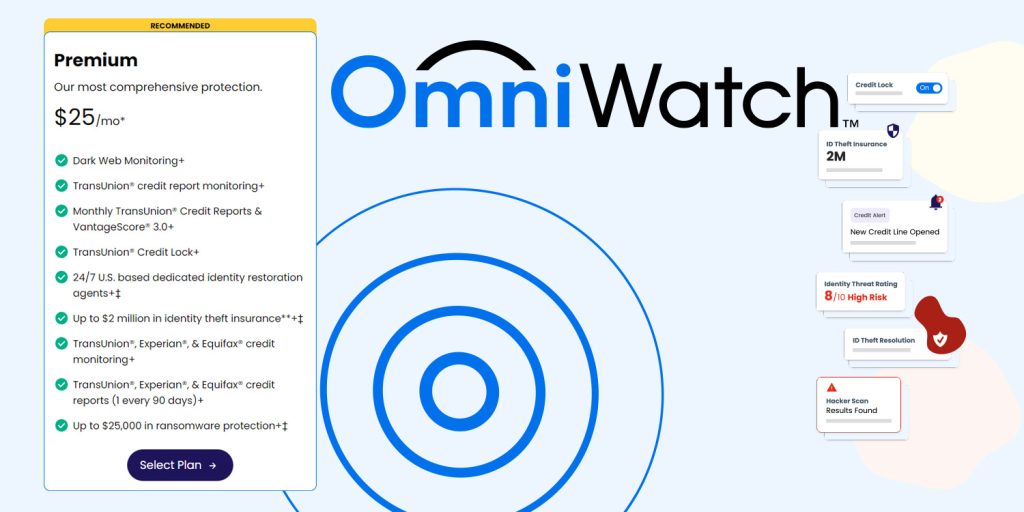

OmniWatch Premium

What it is

The modern world is constantly changing and evolving, which means that threats are as well. Whether it’s dangerous links included in an e-mail that leads to ransomware and total data loss or a purchase made on a website designed for phishing, for example, some individuals want additional protection.

While the OmniWatch Premium plan only offers a few more features than the basic plan, it’s this limited addition of features that can make all the difference.

How it works

The OmniWatch Premium plan includes everything listed in the basic plan as well as:

- TransUnion®, Experian®, & Equifax® credit monitoring (the basic plan only covers Transunion monitoring, which can exclude the other major credit bureaus who may report discrepancies that you could miss by only monitoring one type of credit report).

- TransUnion®, Experian®, & Equifax® credit reports (1 every 90 days)

- Up to $25,000 in ransomware protection (ransomware is a type of malware that locks access to your computer system until you contact the hackers and provide them with the requested ransomware, which still may not grant you access to all of your files and data).

This more comprehensive coverage can be good for those who want greater coverage, even if it’s only in the form of monitoring two more credit bureaus and receiving coverage for ransomware that could strike at any moment.

If you want to get the most out of your OmniWatch plan, the OmniWatch Premium option is the best choice.

Learn more about OmniWatch Premium today

What You Should Know Before Using OmniWatch

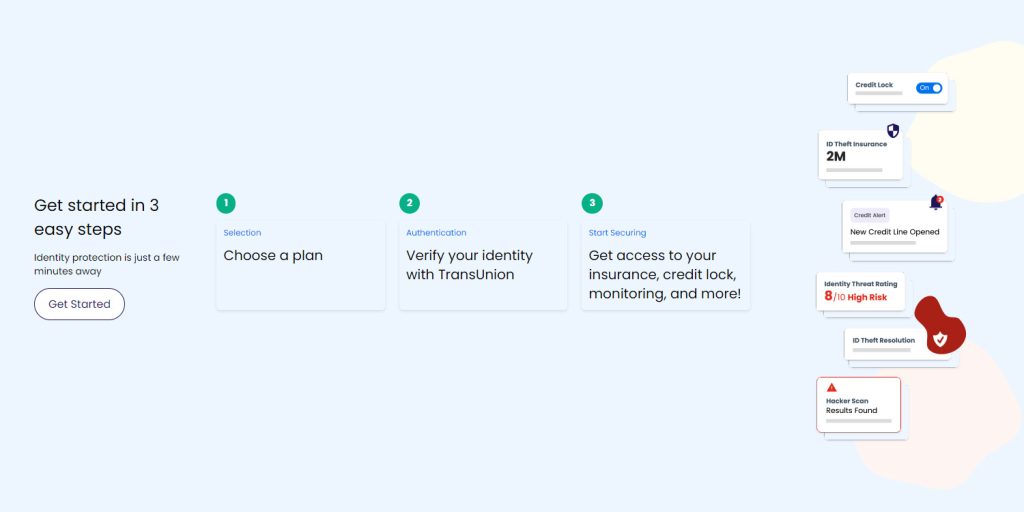

Signing up for any identity protection service requires careful consideration. Here’s what you need to know before signing up and using OmniWatch to remain confident in your plan purchase.

Pricing

Most consumers appreciate the competent pricing for OmniWatch. To begin with, everyone who’s interested in OmniWatch identity theft protection can get started by taking advantage of their seven-day $1 trial run. Once that ends, they can either stick with the $9.99/month Basic plan or the $14.99/month Premium plan.

It’s important to note that signing up once and then canceling later will not provide you with continuous protection services. You must continue to pay for a subscription to benefit from the services and alerts they offer.

Brand Values

OmniWatch is a company highly dedicated to addressing widespread identity theft in today’s world, providing their consumers with the highest possible value at the best prices, and offering a higher-quality level of support that their users may not be able to find elsewhere.

If there are any questions that you may have along the way, they make it very clear that you can reach out to them to receive the guidance you need to make the right choice for your digital monitoring needs.

Customer Support

They offer you the coverage and access to support you would need should you become a victim of identity theft. With that in mind, the more coverage you get (by upgrading plans), the more effective your purchase will be.

Return and Refund Policies

OmniWatch does not offer physical services, so they do not offer return or refund policies like regular services. If you experience any issues with your service that they should know about, we highly recommend reaching out to them so you can express your concerns and receive a refund, if necessary.

FAQ

Is OmniWatch legit?

OmniWatch is a legitimate company. There are no reports online that would indicate otherwise nor are there consumers who have reported a negative experience to the Better Business Bureau complaining about being scammed or ripped off.

You should feel safe signing up for their services and providing them with the necessary personal information to get the most out of their solutions.

What is identity theft insurance?

Aptly named, identity theft insurance is a form of insurance that provides coverage for those affected by identity theft. As mentioned above, this may cover legal support, loss of income, and loss of money when someone manages to access bank accounts or beyond. These days, apps like a fitness tracker collect so much information, from your blood pressure to calories burned. But they also take credit card information, passwords, and more–and you can’t get a full refund when your identity is stolen or posted on the dark web.

Do I need credit monitoring?

Credit monitoring is an excellent service for everyone to tap into. Not only does it help you stay on top of your credit score and keep tabs on your financial health, but it can also help you identify any discrepancies in your credit history or usage that could indicate someone else is using credit accounts in your name.

An alert on your credit score could show when someone uses your credit card without your knowledge.

What is the dark web?

The dark web is a part of the deep web that requires you to use TOR to access it. Individuals who specialize in stealing and selling personal data and payment information may do so because of the inherent security and the overall lack of awareness that normal consumers have regarding it.

Monitor Your Information With OmniWatch

Identity theft is serious, and having the protection you need to ensure you deal with it promptly and effectively can make all the difference. OmniWatch’s comprehensive plans and approach give you the support you need to protect yourself both now and in the future. If you wish to stay more secure in the digital world, OmniWatch is an excellent choice.